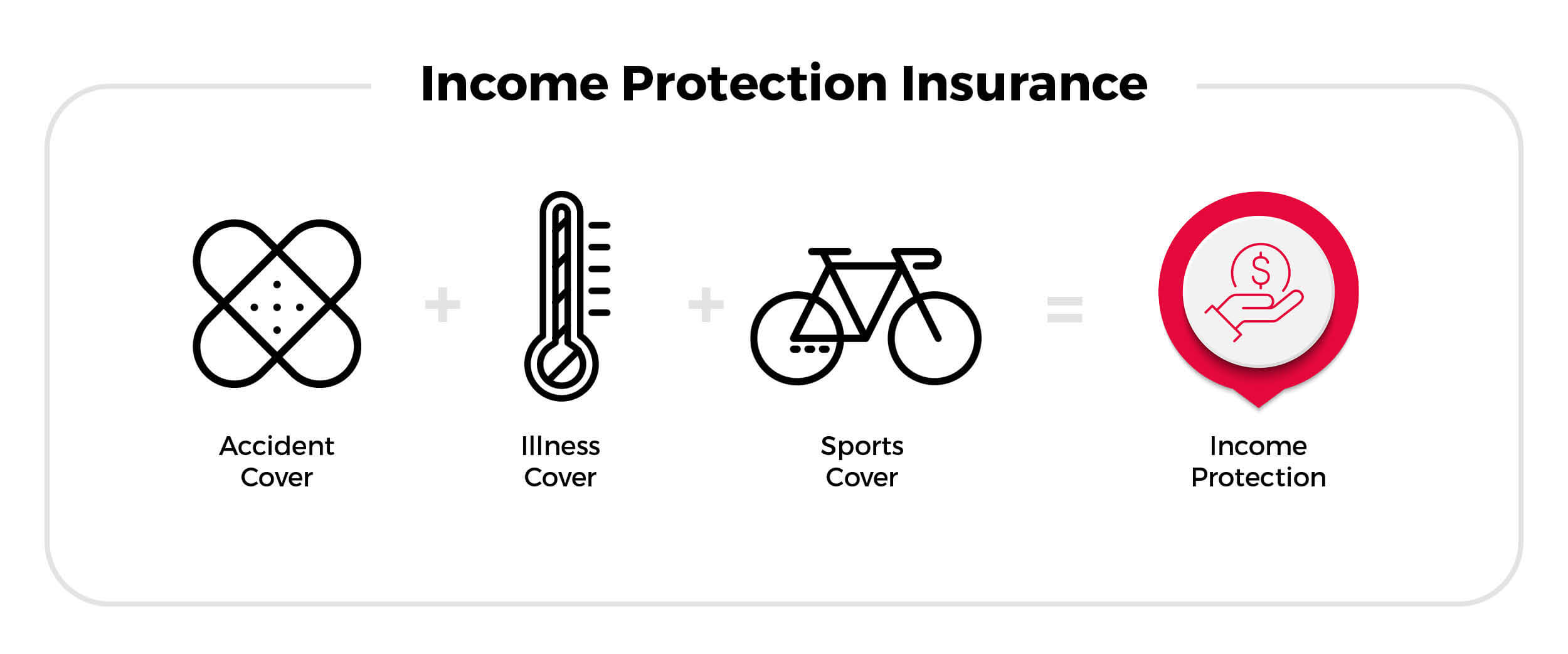

Income Protection Insurance

Welcome to Smart Private Wealth • Services • Personal Insurance

Welcome to Smart Private Wealth • Services • Personal Insurance

Income Protection gives you an alternative source of income if you are temporarily unable to work due to an illness or injury that has left you Totally Disabled or Partially Disabled. It takes the pressure off your day to day running costs so you can focus on recovery with minimal stress.

A monthly payment for a nominated period of time can help you keep your household up and running, and provide for your loved ones while you

recover.

For comprehensive cover details and for information on our insurance underwriter, please get in touch with the Smart Private Wealth team.

A testamentary trust is commonly used by estate planning lawyers to protect the assets and inheritance of the testator’s benefciaries from creditors, family law actions and providing flexibility in relation to the distribution of the estate.

There are limits on how much you can pay into your super fund each financial year without having to pay extra tax. These limits are called ‘contribution caps’.