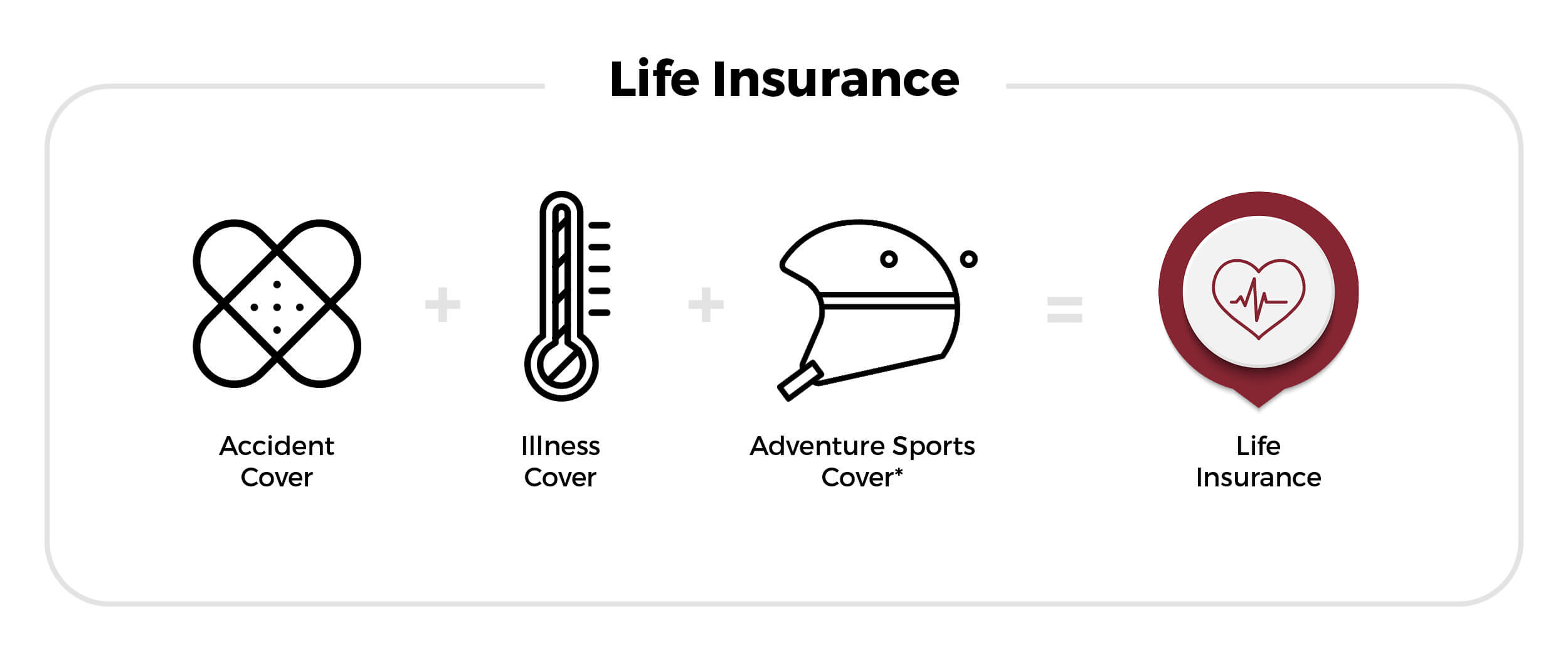

Life Insurance

Welcome to Smart Private Wealth • Services • Personal Insurance

Welcome to Smart Private Wealth • Services • Personal Insurance

Life insurance provides for your loved ones in the event of your death, or if you are diagnosed with a terminal illness. A life

insurance policy provides a lump sum payment to your loved ones to ensure their financial security and the ability to continue to pay for

things such as the family home, children's education and living expenses.

The payment is conditional to the type of cover you choose. For instance, if you take out the Illness Only cover, you would not receive

the Death Benefit if you passed away as a result of an Accident or Adventure Sport.

A testamentary trust is commonly used by estate planning lawyers to protect the assets and inheritance of the testator’s benefciaries from creditors, family law actions and providing flexibility in relation to the distribution of the estate.

There are limits on how much you can pay into your super fund each financial year without having to pay extra tax. These limits are called ‘contribution caps’.